Hello, dear readers!

Navigating the world of finance and accounting can feel like learning a new language, especially if it’s not something you deal with daily. But don’t worry! Today, we’re going to simplify some terms that you might have heard but aren’t sure about: cost, cost driver, manufacturing cost, and non-manufacturing cost. Let’s make this as easy as pie!

Cost: What Do You Understand from It?

Think of cost as the price of something. It’s what you give up (usually money) to acquire something else. If you buy a pair of shoes for $50, that $50 is the price/cost of the shoes.

Cost Driver: The Reason Behind the Price of an Item

Let’s assume you’ve thrown a party. The more people you invite, the more food and drinks you’ll need, right? So, the number of guests “DRIVES” your spending on food. In financial terms, this number of guests is a cost driver. It’s a factor that affects how much you spend.

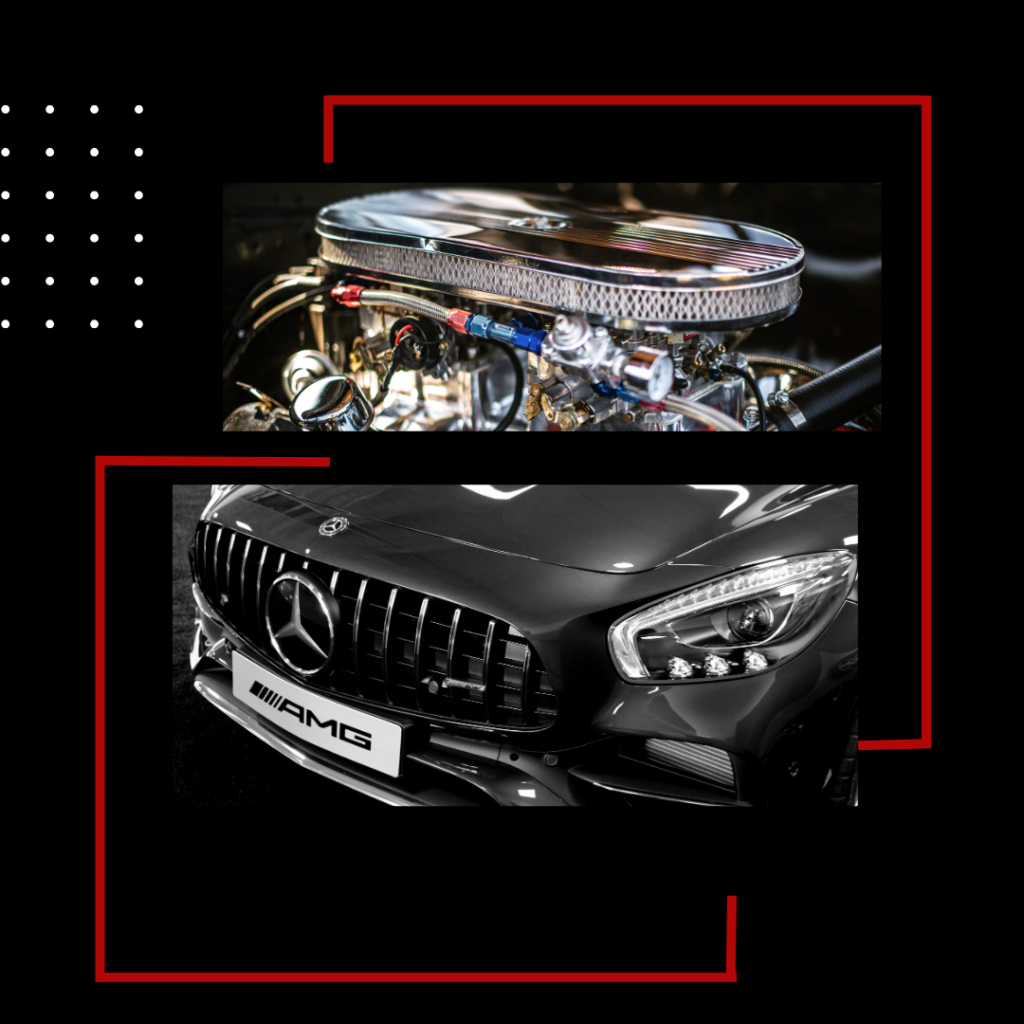

Manufacturing Costs: Making Things Costs Money

When we prepare food in the kitchen, we use various ingredients. Similarly, when companies produce products, such as cars or chocolate bars, they spend money in the process. This expenditure is termed the manufacturing cost. Broadly speaking, the main components of this cost are:

- Direct Material: The tangible items used to create the product.

- Direct Labour: The effort required to produce the item. In manufacturing, this refers to the workers who contribute to the product’s creation.

- Manufacturing Overhead: Any other costs that aren’t direct material or labor. For instance, the electricity used by an oven to bake a cake would be considered a manufacturing overhead cost.

Non-Manufacturing Costs: Other Important Costs

From a manufacturer’s perspective, it’s not just about producing the product. We also need people to sell the product and manage our business. Examples include a salesperson who visits various shops to secure sales orders or a cashier who collects payments. These roles aren’t directly involved in manufacturing but are essential costs to consider. Since they aren’t part of the production process, we categorize them as non-manufacturing costs. They include:

- Selling Costs: Expenditures related to selling the product, such as TV advertisements or discounts during a sale.

- Administrative Costs: Expenses associated with running the business, including office rent, salaries of office workers, and office supplies.

In Conclusion

Costs are everywhere, and understanding them can help us make better decisions, whether we’re running a business or just managing our household budget. Remember, finance doesn’t have to be complicated. Sometimes, it’s just about understanding the basics and asking the right questions. Before ending the blog, i would like to know your thoughts on below

Consider a local bakery or coffee shop you frequent. What do you think are some of their most significant manufacturing and non-manufacturing costs? If they decided to start a delivery service due to increased demand, how might that introduce new cost drivers? Tell me your answers in the comment box below. Until we meet again. Cee Ya.